TransactionType

TransactionType DynamicDescriptor

DynamicDescriptor Recurring

Recurring Installment

Installment EndDate

EndDate Periodicity

Periodicity RecurringMethod

RecurringMethod CurrentTotals

CurrentTotals TotalDiscount

TotalDiscount TotalTax

TotalTax TotalShipping

TotalShipping TotalDeductible

TotalDeductible Total

Total CouponCode

CouponCode TransactionDiscount

TransactionDiscount TransactionTax

TransactionTax TransactionConvenienceFee

TransactionConvenienceFee ChargeDate [Not Supported for ACH/eCheck]

ChargeDate [Not Supported for ACH/eCheck] ReferenceTransaction

ReferenceTransaction OrderNumber

OrderNumber VaultGUID

VaultGUID GiftCardList

GiftCardList GiftCard

GiftCard GiftCardCode

GiftCardCode GiftCardAmount

GiftCardAmountCnPAPI.Engine.Request.Order.Transaction

Elements:

- TransactionType

- DynamicDescriptor

- Recurring

- CurrentTotals

- CouponCode

- TransactionDiscount

- TransactionTax

- TransactionConvenienceFee

- ChargeDate

- CustomParameters

- ReferenceTransaction

- GiftCardList

Schema

<xsd:element name="Transaction">

<xsd:complexType>

<xsd:sequence>

<xsd:element ref="TransactionType" minOccurs="0"/>

<xsd:element ref="DynamicDescriptor" minOccurs="0"/>

<xsd:element ref="Recurring" minOccurs="0"/>

<xsd:element ref="CurrentTotals" minOccurs="0"/>

<xsd:element ref="CouponCode" minOccurs="0"/>

<xsd:element ref="TransactionDiscount" minOccurs="0"/>

<xsd:element ref="TransactionTax" minOccurs="0"/>

<xsd:element ref="TransactionConvenienceFee" minOccurs="0"/>

<xsd:element ref="ChargeDate" minOccurs="0"/>

<xsd:element ref="CustomParameters" minOccurs="0"/>

<xsd:element ref="ReferenceTransaction" minOccurs="0"/>

<xsd:element ref="GiftCardList" minOccurs="0"/>

</xsd:sequence>

</xsd:complexType>

</xsd:element>

Example

<Transaction>

<TransactionType>Authorize</TransactionType>

<DynamicDescriptor>DynamicDescriptor

| Phone</DynamicDescriptor>

<Recurring>

<Installment>2</Installment>

<Periodicity>2

Months</Periodicity>

</Recurring>

<CurrentTotals>

<TotalDiscount>800</TotalDiscount>

<TotalTax>900</TotalTax>

<TotalShipping>500</TotalShipping>

<TotalDeductible>700</TotalDeductible>

<Total>4600</Total>

</CurrentTotals>

</Transaction>

TransactionType

|

Name |

TransactionType |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.TransactionType |

|

Description |

The type of transaction this order represents. |

|

Data Type |

String |

|

Range |

Authorize: Transaction will not settle and will need to be

settled manually. Payment: Transaction posted as settled and is final.

|

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.2 |

|

Required |

Yes |

|

Example |

<TransactionType>Payment</TransactionType> |

Schema

<xsd:element name="TransactionType">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>The type of transaction this order represents.</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:string">

<xsd:enumeration value="Authorize"/>

<xsd:enumeration value="Payment"/>

<xsd:enumeration value="PreAuthorization"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

DynamicDescriptor

|

Name |

DynamicDescriptor |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.DynamicDescriptor

|

|

Description |

The name that appears on the card holder’s statement. |

|

Data Type |

Minimum: blank Maximum: 39 characters |

|

Range |

Maximum 39characters |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.2 |

|

Required |

It is required only for In-house account. Ignored for the

merchant accounts. |

|

Example |

<DynamicDescriptor>Campaign of VA |

5409619811</DynamicDescriptor> |

IMPORTANT

POINT:

The

dynamic descriptor has to include the phone number where a card holder may

contact the organization. It has to be similar to the example provided.

Schema

<xsd:element name="DynamicDescriptor">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>The name that appears on the card holder’s statement.</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:string">

<xsd:maxLength value="39"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

Recurring

CnPAPI.Engine.Request.Order.Transaction.Recurring

Elements:

Schema

<xsd:element name="Recurring">

<xsd:complexType>

<xsd:sequence>

<xsd:element ref="Installment" minOccurs="0"/>

<xsd:element ref="EndDate" minOccurs="0"/>

<xsd:element ref="Periodicity"/>

<xsd:element ref="RecurringMethod" minOccurs="0"/>

</xsd:sequence>

</xsd:complexType>

</xsd:element>

Example

<Recurring>

<Installment>2</Installment>

<Periodicity>2

Months</Periodicity>

</Recurring>

Installment

CnPAPI.Engine.Request.Order.Transaction.Recurring.Installment

|

Name |

Installment |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.Recurring.Installment

|

|

Description |

The number of times a payment will be replicated. |

|

Data Type |

Int16 |

|

Range |

Minimum: 2 Maximum: 999 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.2 |

|

Required |

No |

|

Example |

<Installment>6</Installment> |

Schema

<xsd:element name="Installment">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>The number of periods the transaction should be repeated.</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:integer">

<xsd:minInclusive value="2"/>

<xsd:maxInclusive value="999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

EndDate

CnPAPI.Engine.Request.Order.Transaction.Recurring.EndDate

|

Name |

EndDate |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.Recurring.EndDate

|

|

Description |

The date when the recurring payments should end. |

|

Data Type |

String |

|

Range |

dd/mm/yy |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.90 |

|

Required |

No [optional – ignored if Installment is used. Use in place

of periodicity. |

|

Example |

<EndDate>15/01/09</EndDate> |

Schema

<xsd:element name="EndDate">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>yy/mm/dd</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:string">

<xsd:pattern value="[0-9][0-9]/[0-9][0-9]/[0-9][0-9]"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

Periodicity

CnPAPI.Engine.Request.Order.Transaction.Recurring.Periodicity

|

Name |

Periodicity |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.Recurring.Periodicity

|

|

Description |

The period for the recurring transaction. After the first

transaction, all subsequent charges will occur with this period. Credit

card expiration date will be checked for validity based on the period and

installments. |

|

Data Type |

String |

|

Range |

It must be one of the following Week 2 Weeks Month 2 Months Quarter 6 Months Year |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.2 |

|

Required |

No. Use either periodicity or EndDate when posting

recurring transaction. |

|

Example |

<Periodicity>2 Months</Periodicity> |

Schema

<xsd:element name="Periodicity">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>The period for the recurring transaction. After the first transaction, all subsequent

charges will occur with this period.

Credit card expiration date will be checked for validity based on the

period and installments.</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:string">

<xsd:enumeration value="Week"/>

<xsd:enumeration value="2 Weeks"/>

<xsd:enumeration value="Month"/>

<xsd:enumeration value="2 Months"/>

<xsd:enumeration value="Quarter"/>

<xsd:enumeration value="6 Months"/>

<xsd:enumeration value="Year"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

RecurringMethod

CnPAPI.Engine.Request.Order.Transaction.Recurring.RecurringMethod

|

Name |

RecurringMethod |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.Recurring.RecurringMethod

|

|

Description |

The

recurring method used. The value will ONLY be used for reporting. |

|

Data Type |

String |

|

Range |

It must be one of the following

|

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.24 |

|

Required |

No. - value is only used in the report |

|

Example |

<RecurringMethod>Subscription</RecurringMethod>

|

Schema

<xsd:element name="RecurringMethod">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation></xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:string">

<xsd:enumeration value="Installment"/>

<xsd:enumeration value="Subscription"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

CurrentTotals

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals

Elements:

- TotalDiscount

- TotalTax

- TotalShipping

- TotalDeductible

- Total

Schema

<xsd:element name="CurrentTotals">

<xsd:complexType>

<xsd:sequence>

<xsd:element ref="TotalDiscount" minOccurs="0"/>

<xsd:element ref="TotalTax" minOccurs="0"/>

<xsd:element ref="TotalShipping" minOccurs="0"/>

<xsd:element ref="TotalDeductible" minOccurs="0"/>

<xsd:element ref="Total"/>

</xsd:sequence>

</xsd:complexType>

</xsd:element>

TotalDiscount

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.TotalDiscount

|

Name |

TotalDiscount |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.TotalDiscount |

|

Description |

Sum

of all individual discounts applied for each item in the list. |

|

Data Type |

long |

|

Range |

Min: 0 Max: 9999999999 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.20 |

|

Required |

No

|

|

Example |

<TotalDiscount>1000</

TotalDiscount > |

Schema

<xsd:element name="TotalDiscount">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>Total discount applied to the order</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

TotalTax

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.TotalTax

|

Name |

TotalTax |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.TotalTax |

|

Description |

Total

tax applied to the transaction |

|

Data Type |

long |

|

Range |

Min: 0 Max: 9999999999 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.20 |

|

Required |

No

|

|

Example |

<TotalTax>1000</TotalTax > |

Schema

<xsd:element name="TotalTax">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>Total tax for the order</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

TotalShipping

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.TotalShipping

|

Name |

TotalShipping |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.TotalShipping |

|

Description |

Total

cost of shipping for the transaction |

|

Data Type |

long |

|

Range |

Min: 0 Max: 9999999999 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.20 |

|

Required |

No. - value is only used in the report |

|

Example |

<

TotalShipping>1000</TotalShipping> |

Schema

<xsd:element name="TotalShipping">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>Total shipping cost for the order</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

TotalDeductible

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.TotalDeductible

|

Name |

TotalDeductible |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.TotalDeductible |

|

Description |

Total

tax deductible portion for the transaction |

|

Data Type |

long |

|

Range |

Min: 0 Max: 9999999999 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.20 |

|

Required |

No

|

|

Example |

<TotalDeductible>2500</TotalDeductible > |

Schema

<xsd:element name="TotalDeductible">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>Total tax deductible portion of the

order</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

Total

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.Total

|

Name |

Total |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.CurrentTotals.Total |

|

Description |

Total

transaction amount |

|

Data Type |

long |

|

Range |

Min: 0 Max: 9999999999 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

1.20 |

|

Required |

Yes

|

|

Example |

<Total>3500</Total > |

Schema

<xsd:element name="Total">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>Total amount to be charged.</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

CouponCode

|

Name |

CouponCode |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.CouponCode |

|

Description |

The type of transaction this order represents. |

|

Data Type |

String |

|

Range |

Min: 0 Max: 50 characters |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.32 |

|

Required |

No |

|

Example |

<CouponCode>ABCDEF-500</CouponCode > |

Schema

<xsd:element name="CouponCode">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation></xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:string">

<xsd:maxLength value="50"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

TransactionDiscount

|

Name |

TransactionDiscount |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.TransactionDiscount

|

|

Description |

The type of transaction this order represents. |

|

Data Type |

long |

|

Range |

Min: 0 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.48 |

|

Required |

No |

|

Example |

< TransactionDiscount>500</TransactionDiscount> |

Schema

<xsd:element name="TransactionDiscount">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>Total discount applied to the transaction</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

TransactionTax

|

Name |

TransactionTax |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.TransactionTax |

|

Description |

Tax associated with the entire transaction |

|

Data Type |

long |

|

Range |

Min: 0 Max: 9999999999 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.48 |

|

Required |

No |

|

Example |

<TransactionTax>123</ TransactionTax> |

Schema

<xsd:element name="TransactionTax">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>Total tax

applied to the transaction</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

TransactionConvenienceFee

|

Name |

TransactionConvenienceFee |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.TransactionConvenienceFee

|

|

Description |

Total convenience fee applied to the transaction |

|

Data Type |

long |

|

Range |

Min: 0 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.50 |

|

Required |

No |

|

Example |

<TransactionConvenienceFee>456</TransactionConvenienceFee> |

Schema

<xsd:element name="TransactionConvenienceFee">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>Total

convenience fee applied to the transaction</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

ChargeDate [Not Supported for ACH/eCheck]

|

Name |

ChargeDate |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.ChargeDate |

|

Description |

The date the transaction should be processed. |

|

Data Type |

date |

|

Range |

YY/MM/DD |

|

Default |

|

|

Operation |

Transaction Operation only for Credit Cards. eCheck/ACH not supported |

|

Input/output |

Input |

|

Version/Release |

2.48 |

|

Required |

No |

|

Example |

<ChargeDate>12/01/30</ChargeDate> |

Schema

<xsd:element name="ChargeDate">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>yy/mm/dd</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:string">

<xsd:pattern value="[0-9][0-9]/[0-9][0-9]/[0-9][0-9]"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

ReferenceTransaction

CnPAPI.Engine.Request.Order.Transaction.ReferenceTransaction

Elements:

- OrderNumber

- VaultGUID

Schema

<xsd:element name="ReferenceTransaction">

<xsd:complexType>

<xsd:sequence>

<xsd:element ref="OrderNumber"/>

<xsd:element ref="VaultGUID"/>

</xsd:sequence>

</xsd:complexType>

</xsd:element>

OrderNumber

|

Name |

OrderNumber |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.ReferenceTransaction.OrderNumber |

|

Description |

The order number for the previous transaction |

|

Data Type |

String |

|

Range |

Max

= 36 characters |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.48 |

|

Required |

No |

|

Example |

< OrderNumber>123456</OrderNumber> |

Schema

<xsd:element name="OrderNumber">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation/>

</xsd:annotation>

<xsd:restriction base="xsd:normalizedString">

<xsd:maxLength value="36"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

VaultGUID

|

Name |

VaultGUID |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.ReferenceTransaction.VaultGUID |

|

Description |

The VaultGUID for the previous transaction |

|

Data Type |

String |

|

Range |

Max

= 36 characters |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.48 |

|

Required |

No |

|

Example |

<VaultGUID>ABCD1234EGFDF4444</VaultGUID> |

Schema

<xsd:element name="VaultGUID">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation/>

</xsd:annotation>

<xsd:restriction base="xsd:normalizedString">

<xsd:length value="36"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

GiftCardList

CnPAPI.Engine.Request.Order.Transaction.GiftCardList

Elements:

- GiftCard

Schema:

<xsd:element name="GiftCardList">

<xsd:complexType>

<xsd:sequence>

<xsd:element ref="GiftCard" maxOccurs="unbounded"/>

</xsd:sequence>

</xsd:complexType>

</xsd:element>

GiftCard

CnPAPI.Engine.Request.Order.Transaction.GiftCardList.GiftCard

Elements:

- GiftCardCode

- GiftCardAmount

Schema

<xsd:element name="GiftCard">

<xsd:complexType>

<xsd:sequence>

<xsd:element ref="GiftCardCode"/>

<xsd:element ref="GiftCardAmount"/>

</xsd:sequence>

</xsd:complexType>

</xsd:element>

GiftCardCode

|

Name |

GiftCardCode |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.GiftCardList.GiftCardCode |

|

Description |

The code for the gift card discount card |

|

Data Type |

String |

|

Range |

Max

= 50 characters |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.48 |

|

Required |

No |

|

Example |

<GiftCardCode>ABCDE123456</GiftCardCode> |

Schema

<xsd:element name="GiftCardCode">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation>GiftCardCode</xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:string">

<xsd:maxLength value="50"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

GiftCardAmount

|

Name |

GiftCardAmount |

|

Path |

CnPAPI.Engine.Request.Order.Transaction.GiftCardList.GiftCardAmount |

|

Description |

The gift card’s discount amount |

|

Data Type |

long |

|

Range |

Min

= 0 |

|

Default |

|

|

Operation |

Transaction Operation only |

|

Input/output |

Input |

|

Version/Release |

2.48 |

|

Required |

No |

|

Example |

<GiftCardAmount>123</GiftCardAmount> |

Schema

<xsd:element name="GiftCardAmount">

<xsd:simpleType>

<xsd:annotation>

<xsd:documentation></xsd:documentation>

</xsd:annotation>

<xsd:restriction base="xsd:long">

<xsd:minInclusive value="0"/>

<xsd:maxInclusive value="9999999999"/>

</xsd:restriction>

</xsd:simpleType>

</xsd:element>

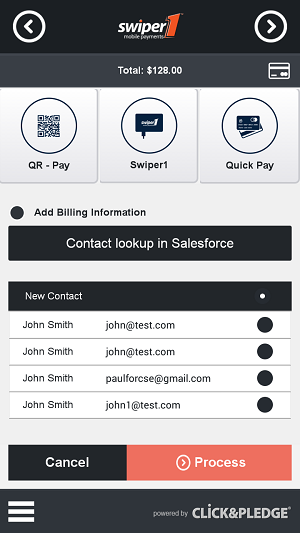

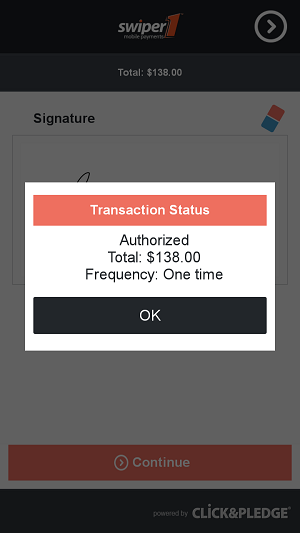

Swiper1 may be used with or without the Swiper. Without the

Swiper1 may be used with or without the Swiper. Without the